Site selection and site analysis

Uncover high-potential sites faster and smarter

One platform for site selection, PV design, and yield estimation

Nearly 80% of PV projects end up in the shade. PVcase turns obstacles into opportunities, securing economic and sustainable success at every stage.

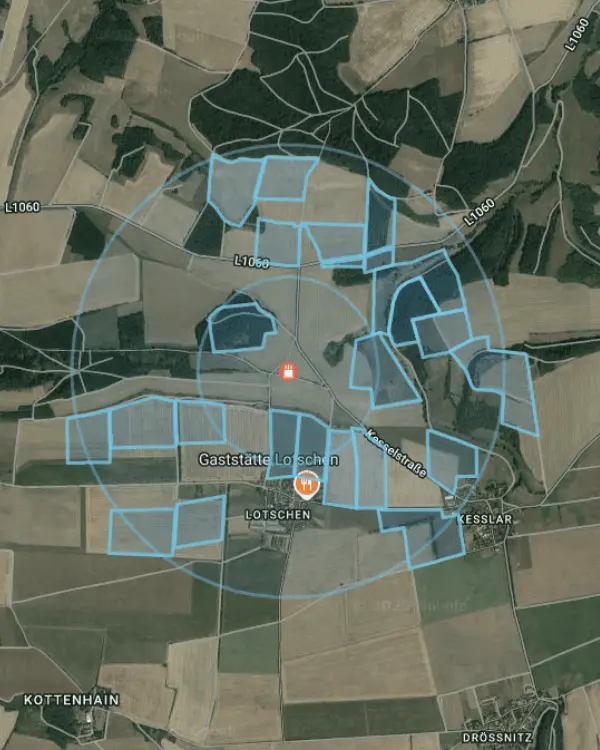

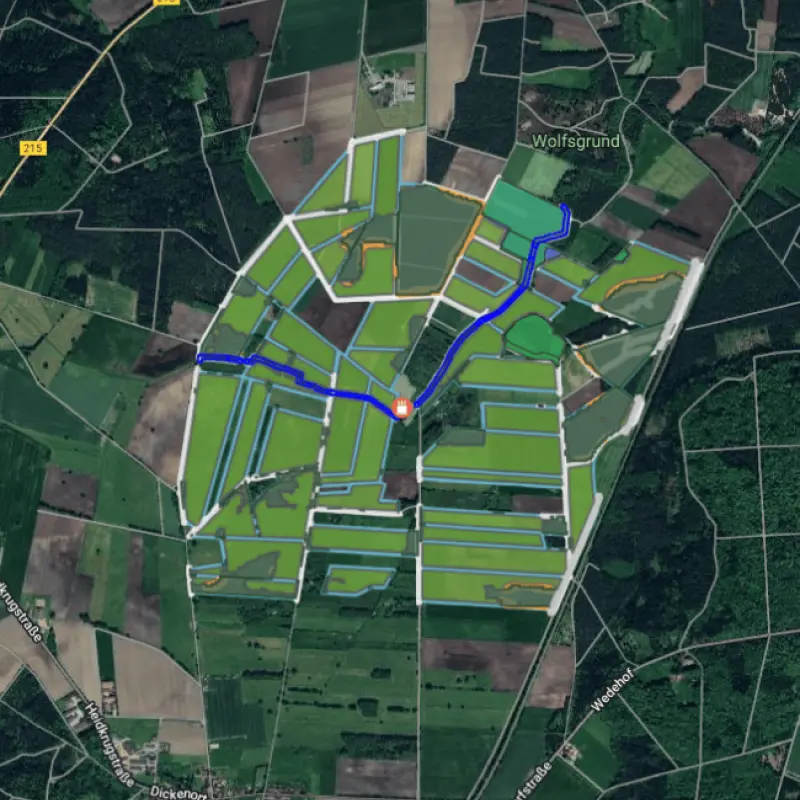

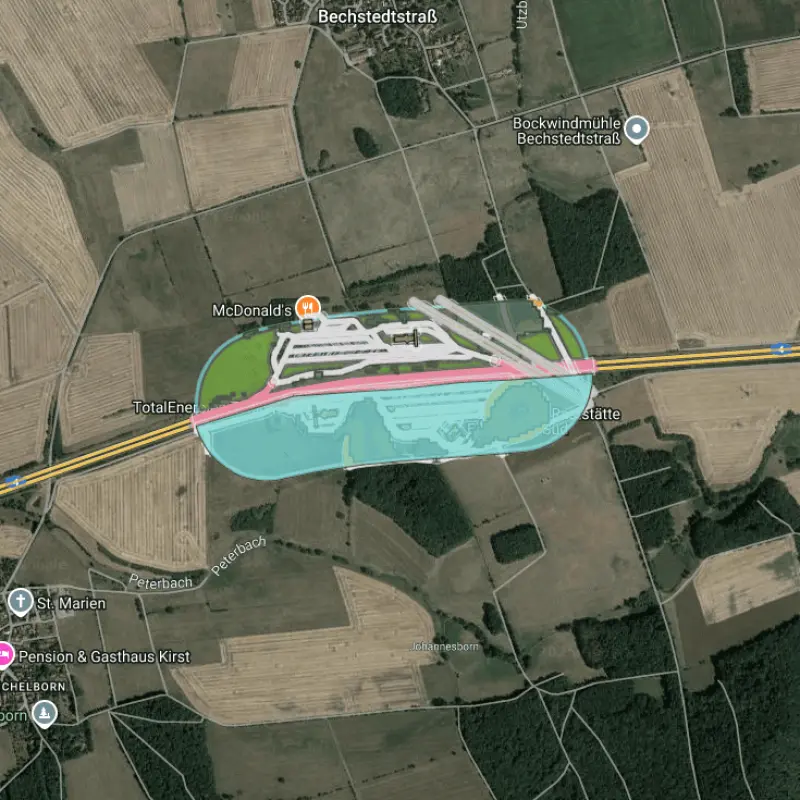

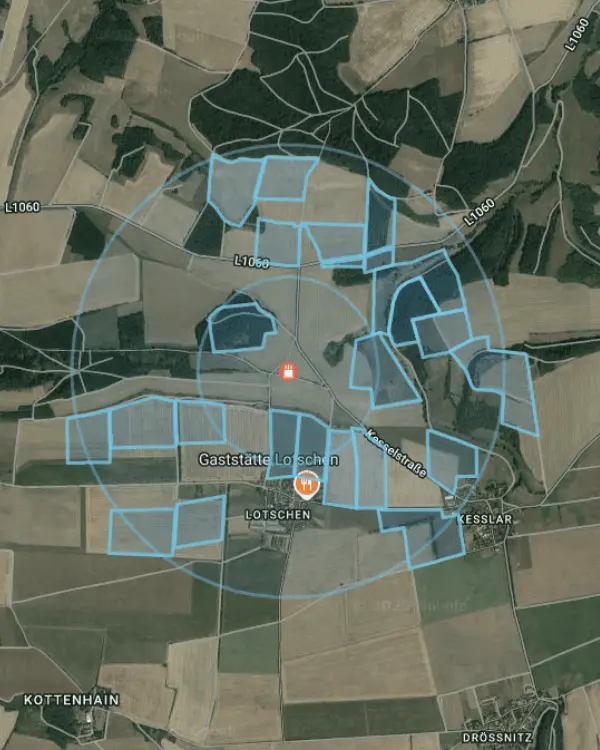

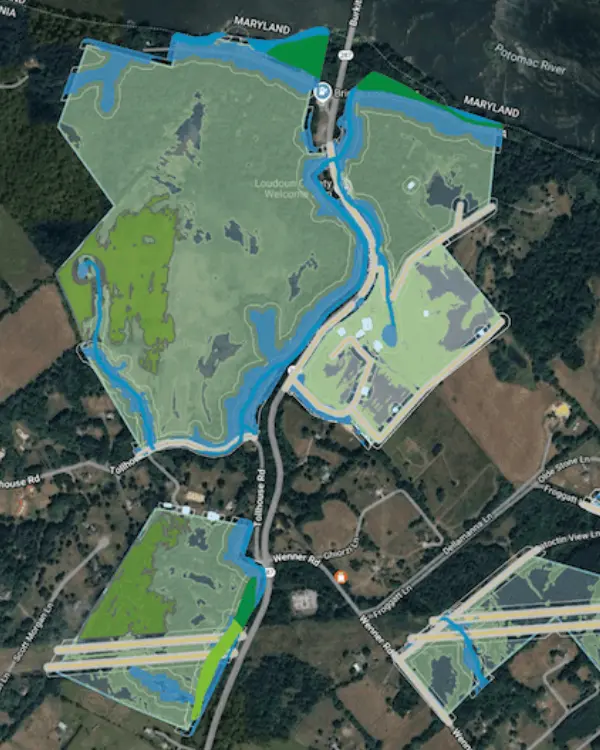

De-risk site selection and enhance early-stage project development due diligence efforts with PVcase Prospect. Stop juggling disconnected tools. Analyze land around the right POIs and uncover the best sites for your projects in minutes – all in one cloud-based platform.

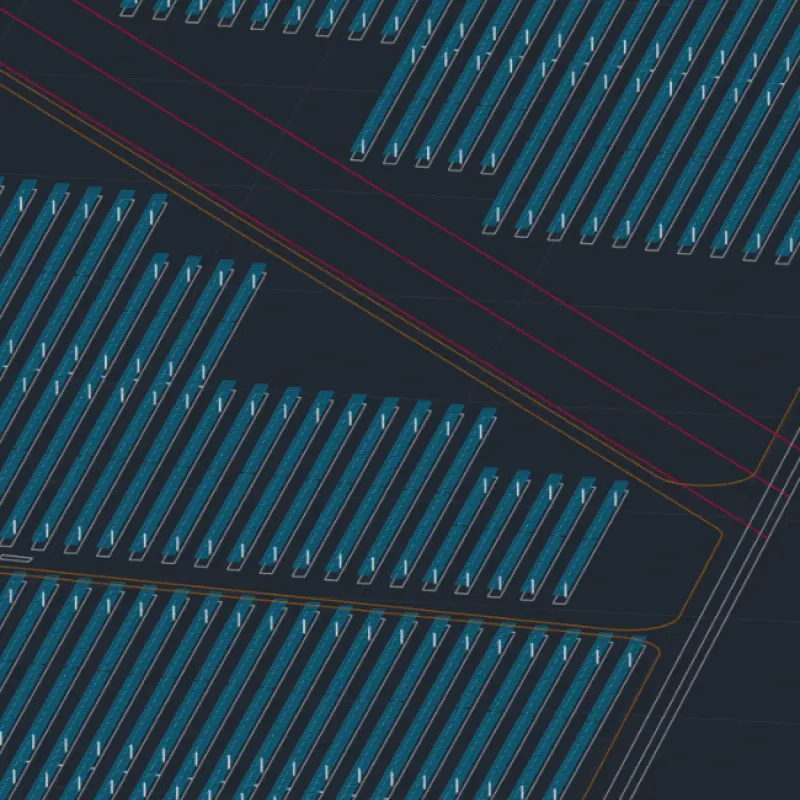

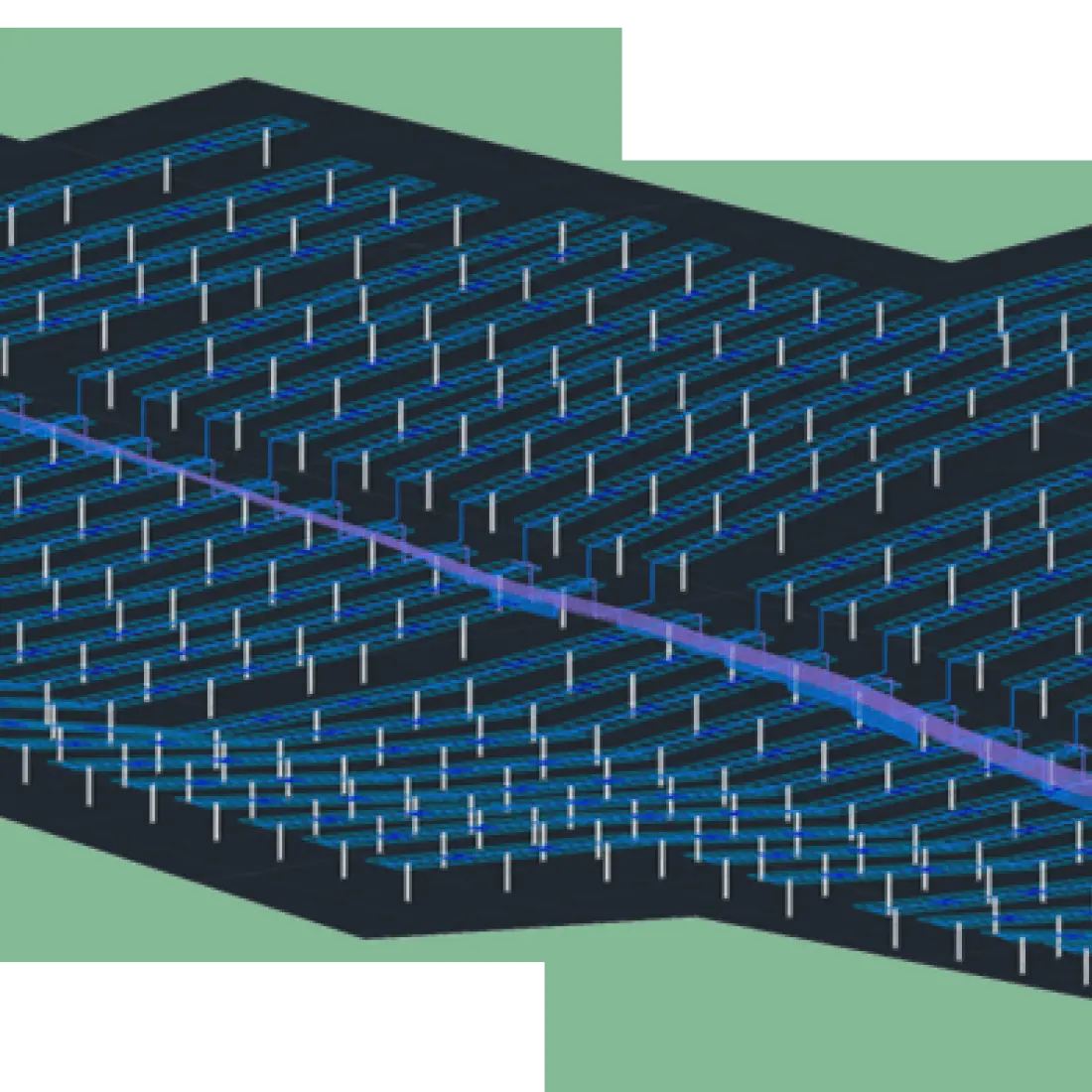

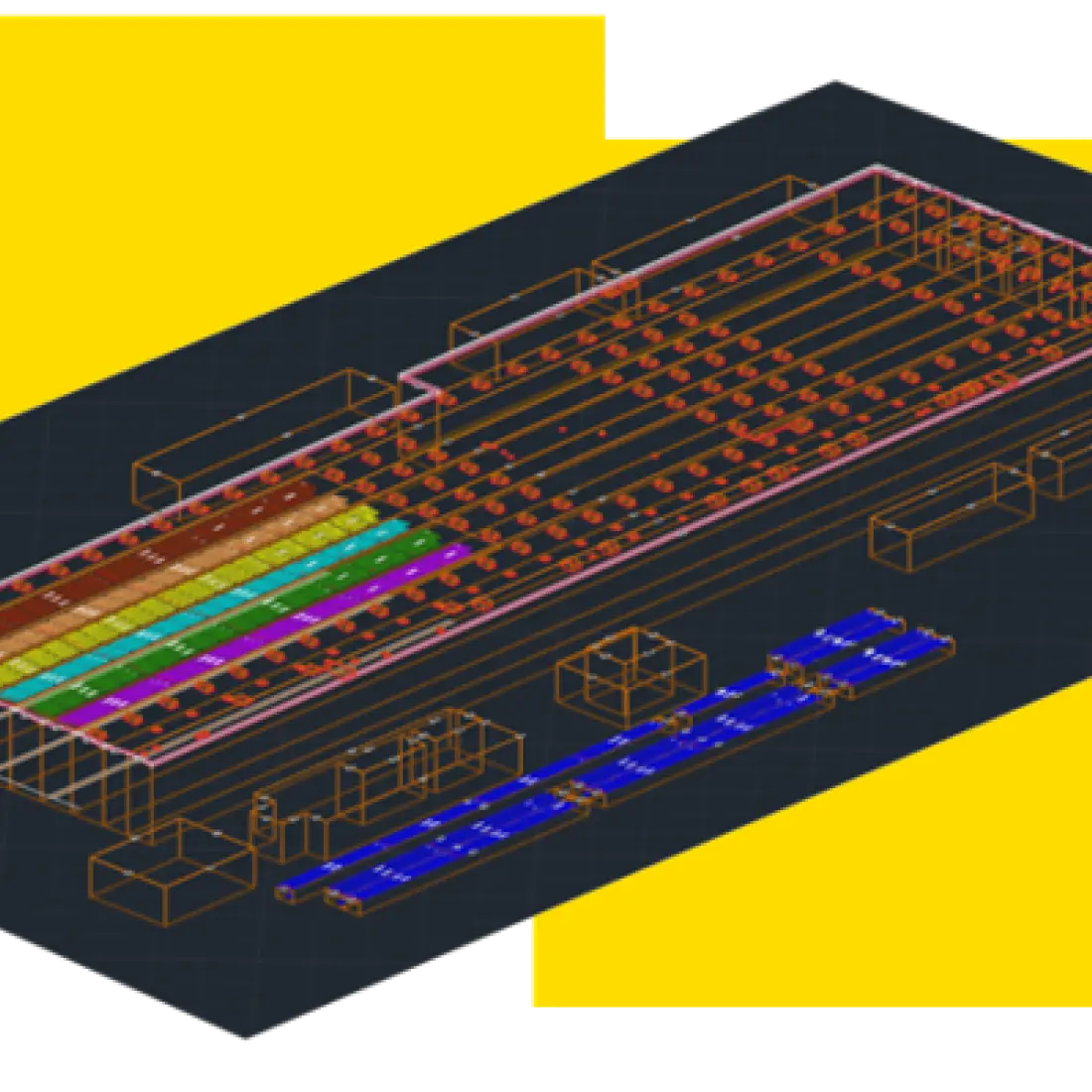

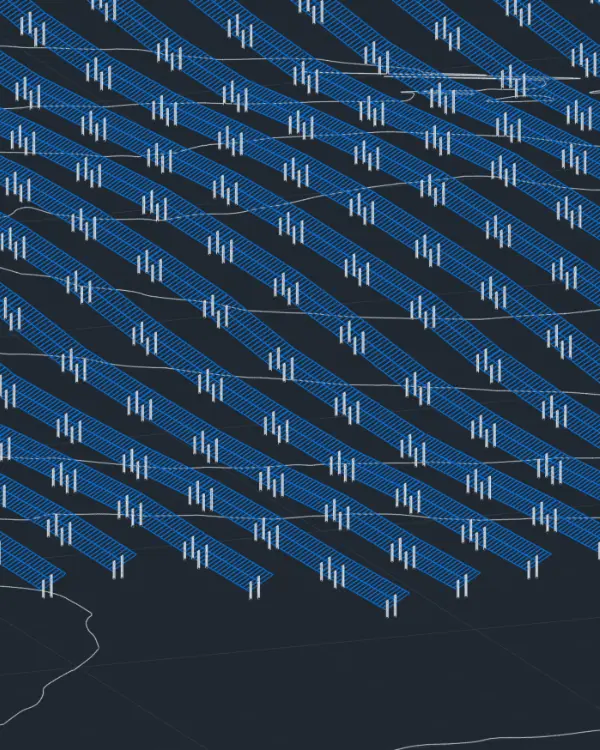

Design construction-ready projects 90% faster. PVcase Ground Mount, built on AutoCAD, automates utility-scale solar design, adapting complex layouts to real-word terrain with unmatched accuracy.

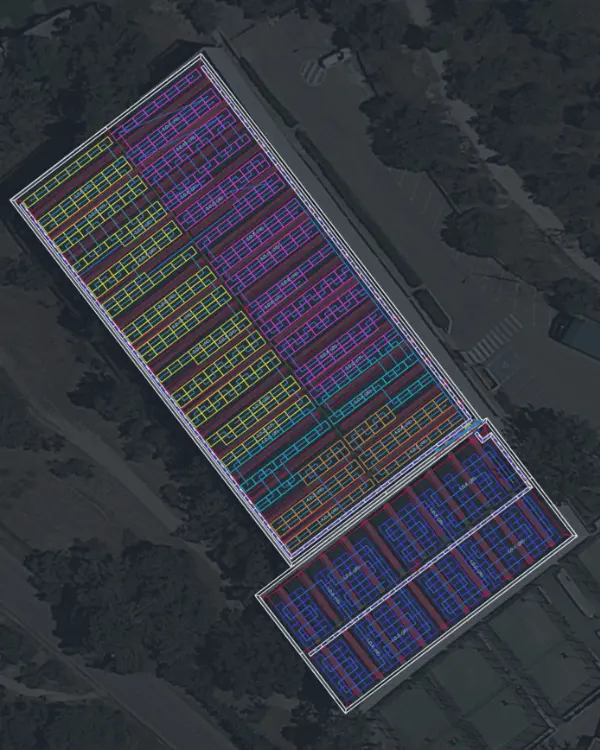

Revamp complex rooftops into powerhouse solar assets. PVcase Roof Mount delivers rapid, precise automated designs, accelerating approvals and project execution.

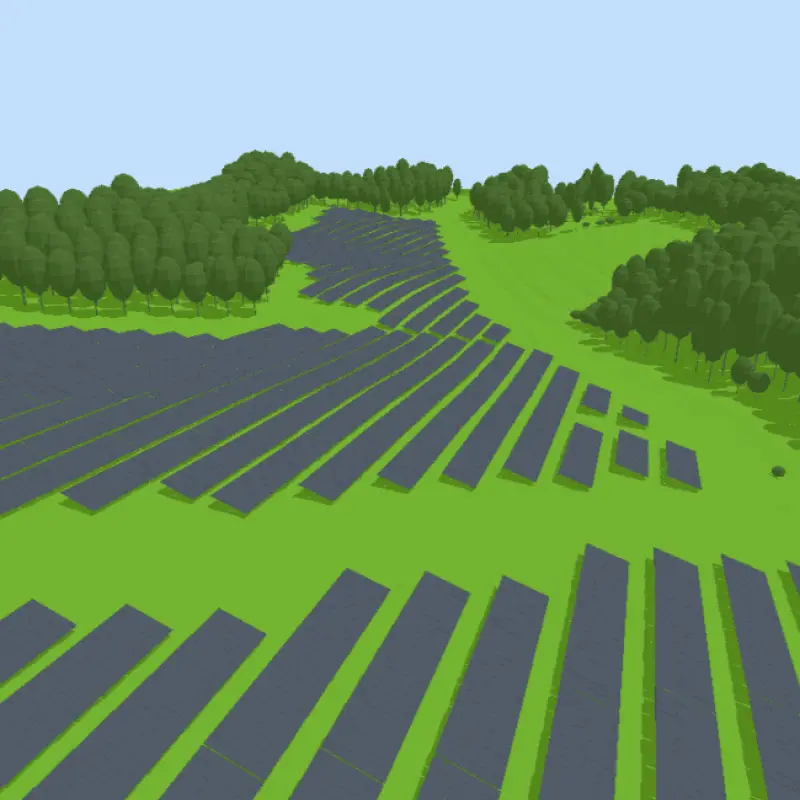

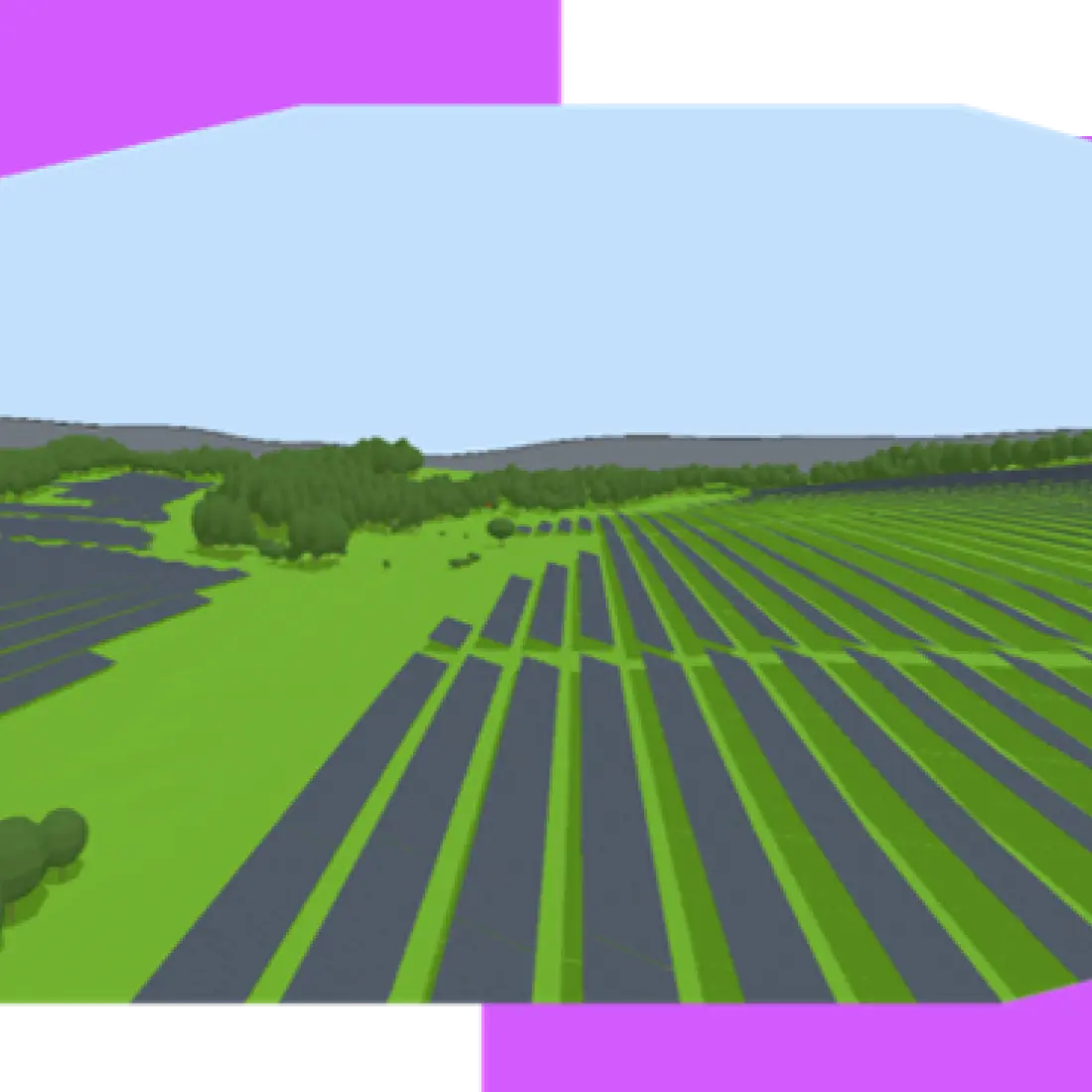

Model with certainty, not guesswork. Connect with PVcase Yield for robust energy modeling, providing crystal-clear insights that strip away risk.

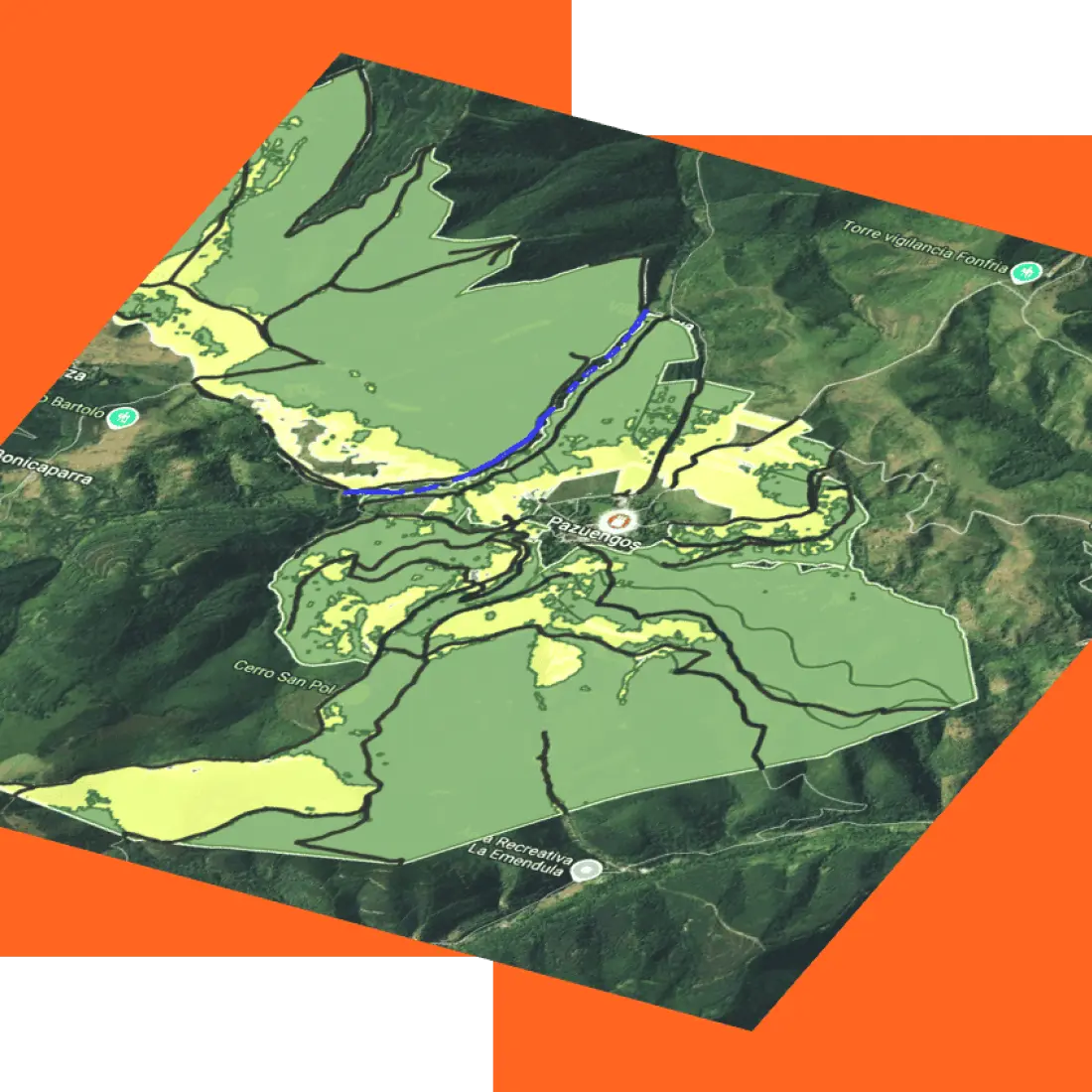

Uncover high-potential sites faster and smarter

Move first on top data center sites using an automated process

Design C&I rooftops faster, smarter, more profitably

Deliver solar projects with speed and unprecedented accuracy

Turn complexity into clarity and confidently move your solar project forward.