International Energy Outlook 2021: Overview

International Energy Outlook (IEO2021), compiled by Energy Information Administration (EIA), analyzes long-term world energy markets in 16 OECD and non-OECD regions through 2050. The predictions are modeled after the current energy trends, existing laws, and accumulative changes to market and technology. The report stressed the projections are uncertain because of potential technological advancements or change in government policies. IEO is developed using the World Energy Projection System (WEPS), which is an integrated economic model encompassing energy supply, demand, and prices in different regions under various conditions. The report underlines the growth of renewable energy, changes in energy trends all over the world, and the persistence of coal in several industries even decades into the future. We’ve taken a look at what was announced in the report and rounded up the key points that we think are most relevant.

Energy consumption and related emissions will increase through 2050

According to the report, renewable energy should reach nearly the same level as the liquid fuels, such as petroleum, however, without significant technological breakthroughs, it’s unlikely the renewables will replace it. Taking into account the changing policies and receding costs, renewables should account for 27% of global energy consumption in 2050. Natural gas consumption is expected to reach 31%, but energy production from natural gas should remain at about 22%. While coal sees a decline in usage through 2030, it will remain one of the most important types of fuel in certain regions that rely on coal as fuel, such as India. Electricity use in households and commercial buildings will grow, and close to 60% of commercial energy needs will be met by electricity, while the transportation sector continues to rely on petroleum. Overall energy consumption will be driven by regional economic growth.

By 2050, global energy use will increase by 50% compared to 2020, mainly influenced by non-OECD countries that are projected to consume twice as much energy as OECD countries; it’s affected by the growing population and rising GDP. In turn, energy-related emissions increase as well, with non-OECD countries causing the majority of the rise. In non-OECD countries, 2050 emissions increase by 35% compared to 2020 levels, while OECD countries should record 5% emissions growth.

Renewables will be the primary source for new electricity generation

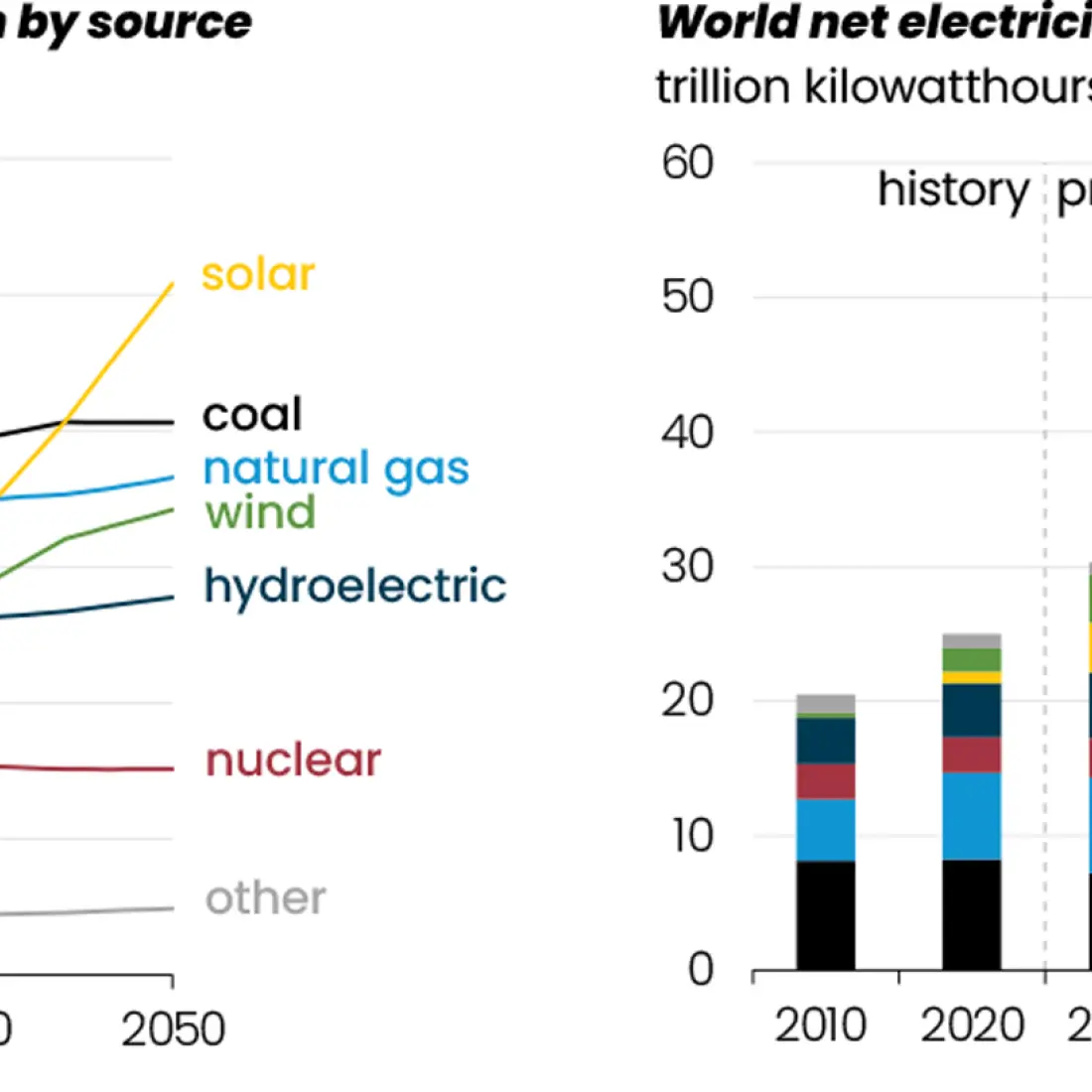

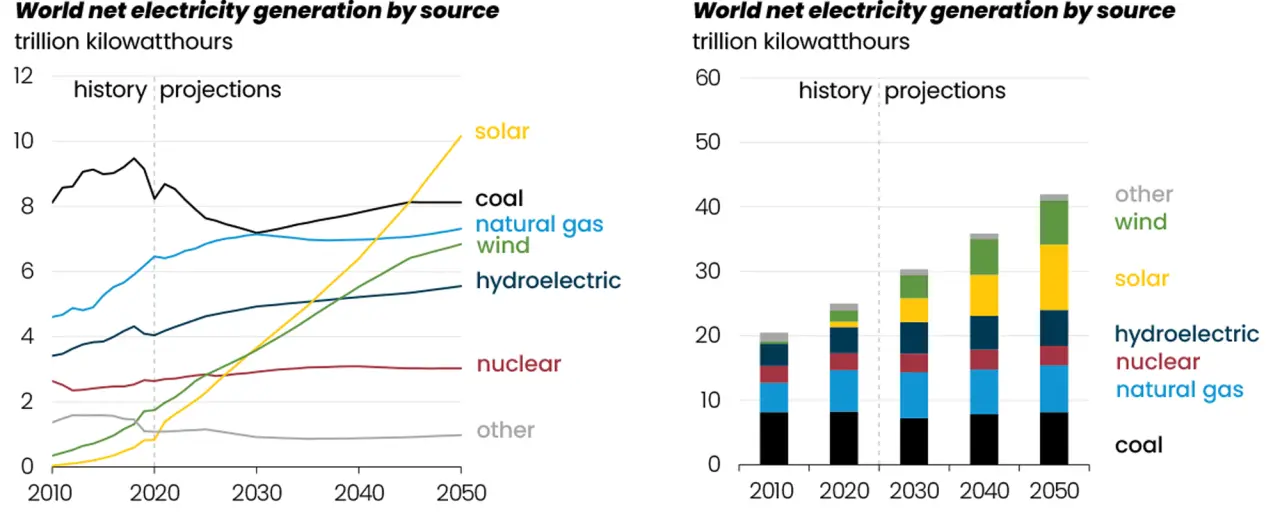

Electricity generation will grow in all observed countries, but non-OECD regions will see a more rapid rise. World consumption of hydroelectricity and other renewable energy is expected to increase from 88.7 quadrillion Btu in 2020 to 235.1 quadrillion Btu in 2050. It represents 3% average annual change for the three decades.

Globally, 2025 should see the start of a steady acceleration for renewables. As wind and solar become cost-effective, in OECD countries they should replace non-renewable sources. In non-OECD countries, renewables account for 90% of generation increases from 2020 to 2050. The projected growth, however, remains uncertain and will largely depend on the regional policies, costs, supply chain, and technology innovation.

Globally, solar is predicted to account for the majority of electricity generation by 2050. Wind, however, falls behind non-renewable sources. Natural gas and coal will remain a viable way to produce electricity, despite fluctuating costs of materials and policy-related restrictions. Based on the report, as electricity demand and production will continue to grow through 2050, the CO2 emissions from electricity generation in non-OECD countries increase by 7%, but decline by 20% in OECD regions. Fossil fuel consumption is predicted to increase emissions by 25%.

Region specifics and emerging markets

While India is considered an emerging market for renewables, the country’s dependence on coal will remain through 2050, though at a reduced capacity. According to a report, India aims for 330 GW of battery storage, which is half of the world’s projected battery storage capacity by 2050. Although coal will remain important to keep growing energy demands, it will account for less than one-quarter of India’s electricity generation by 2050, while wind and solar resources will make up for two-thirds.

At the other end of the spectrum, Canada is expected to make use of its natural resources, such as wind, which sees growth through 2050, and hydroelectric, which remains a steady source of electricity between 2010 and 2050. Solar retains its popularity, but the need for extensive battery storage remains. Wind generation also cannot always be consistent, so in all regions, other resources like natural gas should be used to maintain steady generation.

China, India, Indonesia, Thailand, and other non-OECD Asia countries are predicted to consume twice as many liquid fuels compared to 2020 levels, impacted by transportation and industrial sectors. In Europe, the use of nuclear and coal sources for electricity generation will decrease, and wind sees exponential growth in the coming decades, followed by solar.

In the US, electricity production from renewables will rise exponentially as well. Solar should reach 47% growth by 2050, and wind rises by 34%. Solar photovoltaic is projected to become cost competitive with natural gas combined cycle.

Key takeaways

According to the data, global energy use increases nearly 50% compared to 2020, yet despite the implementation of various policies, global carbon dioxide emissions still rise through 2050.

Many non-OECD Asia countries will remain dependent on non-renewables due to growing industry needs, affecting the worldwide statistics.

Renewables will become the primary source for new electricity generation, but coal-based generation will retain its significance.

Globally, solar stands out among the renewables according to electricity generation by 2050.

Learn more about the solar industry and find out how you can mitigate PV design challenges.