Large Scale Solar USA: Managing US solar risks

Two weeks ago PVcase traveled to Austin, Texas for a two-day deep dive into the USA’s solar market. It is the world’s second-largest single-country market after China with 24 GW deployed in 2021, 17 of which were utility-scale. While the world broke through the TW-scale era, the USA got into the 100 GW club with 122 GW of cumulative capacity installed.

The US is leading the global transition into the use of tracker systems: more than half of all projects using tracker systems in 2020 were deployed in the USA, as virtually all utility-scale projects in the country were built with trackers. And the appetite for more solar remains strong, as the US has an 80 GW utility-scale solar project pipeline with increasingly larger, 300 to 500 MW-size mega projects being built.

Despite this vigorous growth and immense potential, the US solar market is undergoing turbulent times as it navigates increasing financial, political, and supply chain risks. While the mood was cautiously optimistic about the future, doom and gloom were nowhere to be seen as Large-Scale Solar Austin demonstrated we have the solutions to ensure the US maintains its top spot in the global solar market.

Large Scale Solar USA. Photos: Solar Media

Faced with chronic project underperformance, US solar looks to mitigate risks

The US solar market is undergoing a shift towards greater solar asset underperformance. As shown in this report by kWh Analytics, solar plants in the USA have consistently shown a high degree of unpredictability to meet their P50 estimates. A more concerning fact is that a growing share of projects built in the last 3 or 4 years has been consistently underperforming their P50 estimates, with 1-in-6 underperforming their P99 estimates. Chronic underperformance is driven by bad weather conditions and the result of technological transitions, as the use of tracker systems and bifacial modules grows. As projects have become larger and more technically complex, the models we use to simulate them have not followed suit – until now.

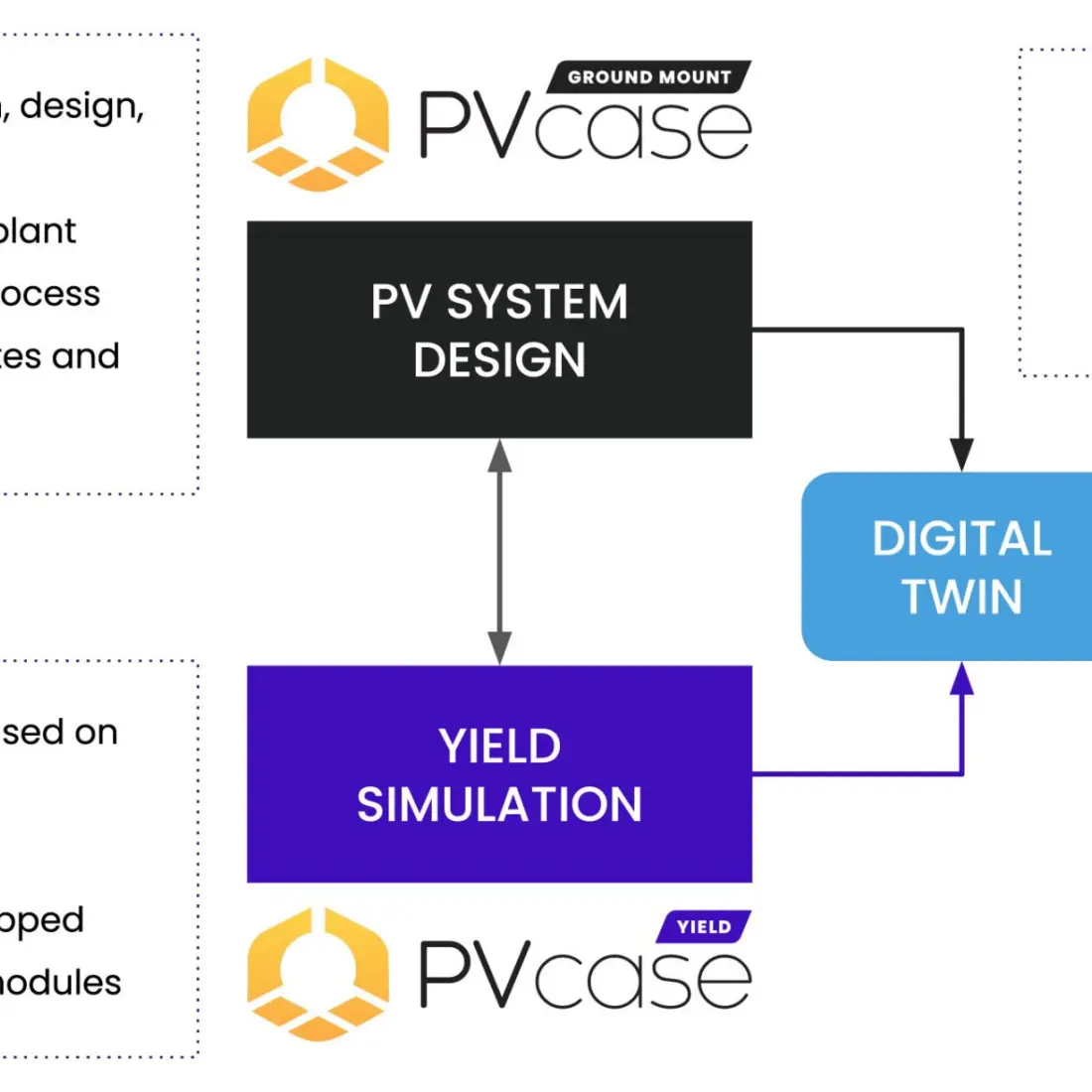

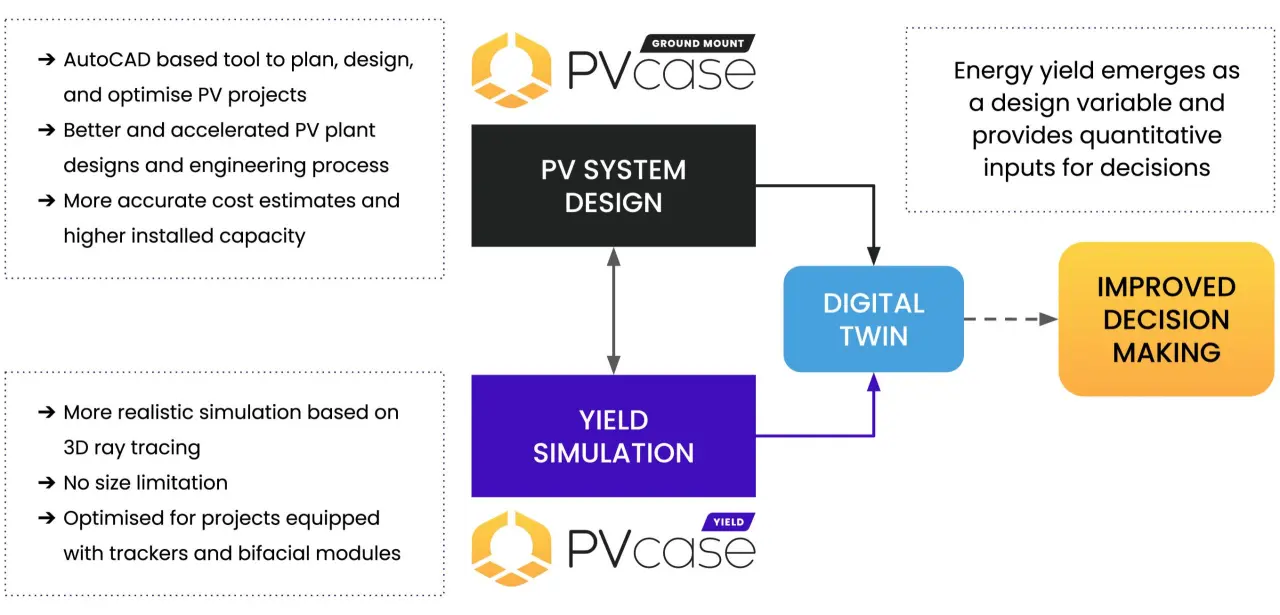

PVcase aims to help project developers and investors reduce this uncertainty by providing the tools required for more accurate PV design projects and yield calculation improvement. Currently, yield assessments require adjustments that increase the need for human input and, consequently, the risk of human error. PVcase Yield integrates the design, engineering, and yield assessment processes, allowing engineers to optimize plant layouts and increase annual energy generation without compromising cost-effectiveness, even at early design stages. Thanks to its ray tracing and thermoelectric physics-based models, PVcase Yield helps you embrace the project complexity and minimize the need for assumptions by increasing the information contained within your models, providing more realistic generation estimates.

In parallel, the US solar sector is increasingly looking to mitigate underperformance risk following a period of reliance on readily available and cheap energy generation insurance. The demand for insurance is dropping significantly. Average insurance rates have increased for 18 consecutive quarters. As some projects devoted up to 25% of the project costs to insurance, project developers and investors are seeking alternative (and cheaper) methods to mitigate their investment risks – particularly important in the context of increasing capital costs. While the bucket of insurance capital for solar projects has grown by $500 billion since last year, accessing this capital is becoming more difficult, as insurers look for projects with low risk that will minimize payouts.

As it matures, the US solar market is moving towards more sophisticated risk mitigation measures. Project developers are relying on early identification and analysis of loss exposures using state-of-the-art simulation tools, the examination of the feasibility, implementation of risk management techniques, continuous result monitoring, and revision of risk management plans. The benefits of managing risk instead of relying on insurance go beyond cost savings. They provide confidence for decision-making and planning, ensure compliance with government regulations, contractual requirements, and community expectations, also, improve stakeholder confidence and improve asset valuation.

To import or not to import: Is that the right question?

In addition to financial uncertainty, the US solar sector is navigating through supply chain uncertainty. While supply chain issues are common throughout all sectors in the global economy, these have been compounded in the USA by protectionist tariffs on the import of solar equipment and tighter ESG requirements for US companies. The latter requirements will hopefully accelerate the development of a more transparent solar supply chain, where potential environmental and social impacts can be removed. Part of this will go through the scaleup of a domestic solar supply chain in the USA, similar to the EU’s plans to develop 20 GW of solar manufacturing capacity by 2025. Conference participants were, however, unclear as to how much of additional costs they would be willing to withstand.

The most important issues for the US solar sector are existing import tariffs and the threat of potential ones. Tariffs are severely reducing the ability of the US solar sector to source sufficient materials to build solar projects in a cost-effective and timely manner. Some speakers reported 5-to-6-month timelines to receive modules and balance of system equipment. Others highlighted developers pay twice as much for solar modules in the USA as they would pay in Germany. These additional complexities and costs were being effectively managed, enabling the USA to install a record amount of solar in 2021. However, the potential introduction of additional and retroactive import tariffs killed the market in the first quarters of 2022 until the moratorium on new import tariffs was announced by President Biden in early June. As a result, according to analysts at the conference, we may not see more than 20 GW of solar being deployed in the USA this year.

ITC extension: the good, the bad, and the ugly

If all this was not enough, the US solar sector is facing huge uncertainty related to the yet-to-be-confirmed extension of the Investment Tax Credit (ITC) - a 26% dollar-for-dollar reduction in the income taxes paid on investments into solar projects in place since 2006. The ITC has been a key factor to enable the tremendous growth in utility-scale capacity additions in the USA, driving a 10000% growth of solar PV in the USA since it was implemented. In 2020, the US Congress delayed the phasedown of the ITC for two years, up to the end of 2022. As we approach a new phasedown of the ITC, which will be reduced to 22% by 2023 and to 10% by 2024, the US solar sector is calling for long-term continuity of the support framework.

What is currently happening is a bit of a good, bad, and ugly situation. The good news is that since October 2021 there's a plan, with bipartisan support in Congress, for a long-term extension of the ITC. This will provide much-needed investment certainty. The bad news is that this extension is currently lumped into the Build Back Better Bill, which is currently stuck in the US Senate. The ugly news is that, according to industry experts in Austin, the extension might not be approved until after the midterm elections on the 8th of November, leaving very little time for the sector to adapt to a more constrained solar project finance reality.

This is a significant problem for the USA’s decarbonization efforts, given the supply chain disruptions and subsequent project delays that took place earlier this year. In a worst-case scenario, in which the ITC is not extended, there will be a rush to complete projects by the end of 2023. In this case, we might face a more than 30 GW spike in capacity additions by the end of the year, followed by a trough in the following years.

This level of uncertainty is neither healthy nor sustainable. While the current predicament lays bare the issues with an industry relying on subsidies to drive its growth, the competitiveness of solar means that it will probably continue to be built, albeit at a slower pace. Nevertheless, in the face of an undeniable climate emergency and an increasingly volatile, risk-laden environment for the solar industry, aren’t tax dollars best spent on supporting the most cost-effective technology to decarbonize our energy system?

In any case, the problems faced today by the solar industry in the USA are not without solutions. However, solving them will require concerted industry efforts to mitigate risks of asset underperformance, the strengthening and partial re-shoring of solar supply chains, and removing politically driven uncertainties – a challenging yet not insurmountable set of hurdles.