Sustainable finance is investing based on environmental, social, and governance (ESG) factors. This thoughtful approach to finance is important to the economic landscape of 2023 and beyond, impacting investors and companies alike. Corporate responsibility calls for attention to detail in every area that impacts ESG, and this includes economic factors. To understand sustainable finance practices, you must first understand ESG as a concept.

Three pillars of ESG

The three frameworks of ESG are environmental, social, and governance. These pillars define how companies report their responsibility efforts. They serve as guidelines to refer to when tracking the impact of the risks and opportunities in the non-financial, daily activities of an organization. This information is valuable not only to the organization, itself, but also to its stakeholders, investors, regulators, employees, and consumers.

In that sense, it directly affects finances through sales, investments, and the securing of funding. The following brief overviews of each ESG pillar will give you an idea of how to safeguard your company for a future in which everyone is more invested in corporate responsibility.

Environmental

Climate change is one of the most prominent reasons for increased interest in ESG reports. The environmental impact of a company reflects on its ethics and willingness to make a difference. While it is one of the most important pillars, environmental factors are also among the most difficult to track. Organizations, especially when larger in scale, have many moving parts. Each of those moving parts has an environmental footprint, whether that be through materials used, waste produced, energy used, or emissions released into the atmosphere.

Social

Social responsibility deals with how an organization treats people, including their employees and community. Reports detail labor practices, resources available for employee development, and ways in which the company gives back to its community and underprivileged groups. Supply chain labor is also included in the social pillar, involving the practices employed by the, ideally, ethical third-party suppliers and manufacturers a company partners with.

Governance

Activities involving laws and regulations fall under the governance pillar of ESG. Most commonly, this includes the rights of shareholders, the diversity of board members, and compensation for executives. Organizations also hold a governance responsibility to avoid corruption, anti-competitive practices, or any other illegal activities.

Demand for sustainable finance

While ESG doesn’t explicitly name finance in its pillar breakdown, it is still a crucial aspect of the entire process. Demand for ESG responsibility among investors allows companies to satisfy this appetite and safeguard their standing in the sustainability-focused future of investing. Consumers and employees are also increasingly looking for corporate responsibility and sustainable practices.

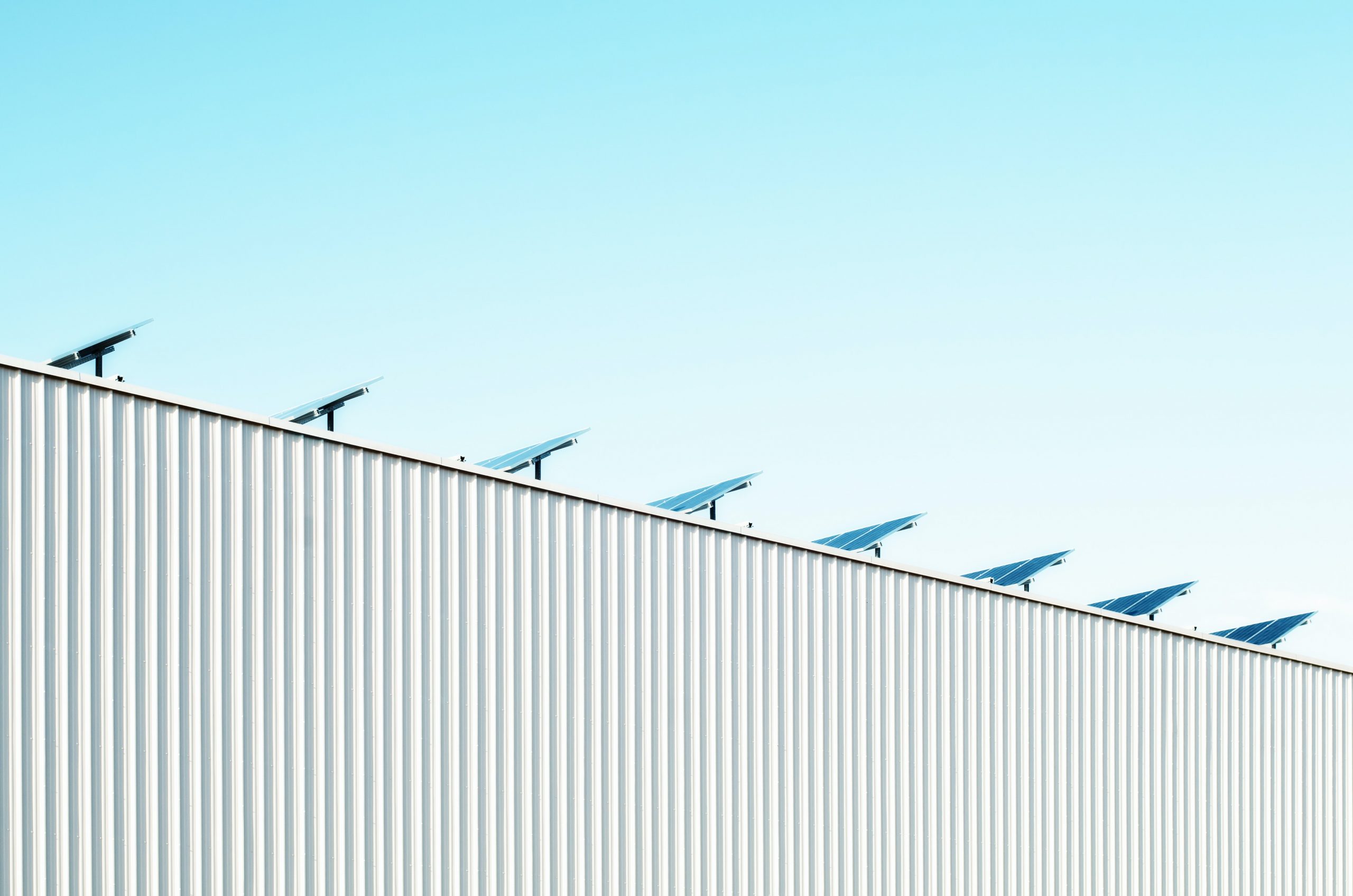

This means that companies must focus on ESG practices to secure sustainable funding while simultaneously drawing in and retaining customers and hires. For example, there is socioeconomic pressure for businesses to adopt rooftop solar. Clean energy procurement is much less costly to have on-site, so companies are looking to install rooftop solar to satisfy consumer and employee demands. Further, it’s not enough anymore to purchase guarantees of origin (GOs) as people are more aware that this is a cheap way to claim responsibility. In reality, GOs are just like buying energy credits. Instead, companies are shifting toward financial investments for on-site solar energy, among other sustainable implementations like electric fleets.

ESG and performance

ESG investing has been gaining in popularity. It’s becoming more and more common for investors to focus on values and sustainability when choosing where to invest funds. In 2021, 2.7 trillion dollars were spent on ESG-related investments globally. That’s a 53% uptick from previous years. Investors are choosing to include only companies that participate in ESG-positive practices in their portfolios — and exclude those that do not.

The implications of this for businesses are far-reaching. The business benefits of ESG strategy implementation include:

- Lower risk of financial volatility;

- Greater corporate financial performance;

- Higher chance of succeeding in emerging markets.

More modern industries are less likely to allow companies with unsustainable products to rise to the top. However, every industry is focused on change in some capacity, and it’s wise to invest in ESG strategies as soon as possible.

Implementing an ESG strategy

When looking to adopt an ESG strategy, you must first look at the three pillars. Each pillar will have varying aspects for your unique industry and type of business. It’s important to bring together board directors, executives, and stakeholders to delineate how your company contributes to each pillar currently, whether that’s positively or negatively. Then, and only then, can you pinpoint areas for improvement and where to focus your efforts for sustainable financial outcomes.

Environmental factors

Although every business’s processes will differ, there are some overarching themes when striving for environmental responsibility. When auditing your impact on the environment, consider whether or not you are currently implementing:

- Renewable energy;

- Carbon offsets;

- Reduced water usage, waste production, and energy consumption;

- Partnerships with responsible third parties.

Environmental impacts can be seen from the manufacturing process to shipping products to consumers. Take stock of every aspect to make a detailed plan for how to move forward in a financially and environmentally responsible way.

Social factors

Similar to environmental initiatives, social standards of ESG should include everything your company does that affects employees, people, and shareholders. Again, this will look different in every company. However, the main goal of social responsibility is to take everyone impacted by your company and its products and services into consideration. When planning your strategy, consider:

- Implementing fair labor practices, like rest periods and maximum hours per week;

- Promoting diversity and inclusion in hiring, marketing, board representation, and more;

- Fostering a safe and respectful work culture, whatever that looks like for your company;

- Reaching out to local organizations to donate products, money, or time;

- Talking with stakeholders of these organizations to see how your products and services impact them, positively or negatively.

Harness feedback from these social groups to dial in on impact. This can also serve as a way to determine where needs can be met through creative strategies. By integrating these strategies into operations and decision-making, you can contribute to the advancement of social standards and enhance your business’s attractiveness to sustainable finance initiatives.

Governance factors

To bolster performance in every other category, including finance, you should emphasize the governance aspects of your operations. This involves establishing robust board structures with diverse, independent directors who can provide effective oversight and strategic guidance. Working together, determine the legality of your current processes and update any guidelines to do so by:

- Establishing clear corporate policies;

- Implementing codes of ethics;

- Putting compliance mechanisms in place.

These governance efforts should be transparent and show the integrity of your company. Following ethical standards is a huge way to show that your company cares about all aspects of ESG and strives for a positive impact on society. Once you’ve established a detailed ESG plan, it’s time to determine how you will report these efforts. These reports will help describe tangible ways that your company has implemented ESG tactics to secure funding, recruit new hires, and attract loyal customers.

ESG reporting

Current global ESG disclosure requirements are in place to give investors a clear picture of what and who they are placing investments into. They include, broadly, that reports must be:

- Relevant: providing accurate data that backs up claims without fluff or “greenwashing;”

- Flexible: allowing for multiple frameworks upon which a business could detail ESG efforts, tailoring each to specific investment vehicles;

- Complementary: bridging the gap between regulation and full accountability.

In other words, reporting that you are keeping up with current ESG requirements is not enough on its own. Presenting tangible data can back up claims of corporate responsibility while detailing exactly what steps you have taken and why.

Sustainable Finance Disclosure Regulation (SFDR)

The EU, in particular, has put in place the Sustainable Finance Disclosure Regulation (SFDR) to ensure those investing money into projects have full transparency on how those projects are committed to sustainability. This framework promotes honesty and consistency in ESG reporting and investment disclosures. Its primary purpose is to provide investors with clear and reliable information about the sustainability of financial products and to prevent “greenwashing,” where investments are falsely presented as environmentally friendly.

By imposing these disclosure requirements, the EU is helping investors make informed decisions. Companies will be best poised to gain funding, then, if you align with sustainable practices and report relevant results. This can open up access to a growing pool of capital from investors who prioritize sustainability, thereby enhancing your competitiveness and long-term financial stability.

The promise of sustainable finance

Sustainable considerations play a pivotal role in ethical financing. This fosters corporate and global responsibility by guiding investments toward more ethical and sustainable ventures and encouraging companies to embrace cleaner and more responsible practices. The transition to clean energy, for instance, aligns with both ESG and the urgent need to combat climate change.

Ultimately, many best practices associated with ESG, such as transparent governance, ethical labor practices, and sustainable resource management, also enhance business resilience. By reducing risks, saving costs, and improving overall performance in the long term, ESG is not just a moral imperative but a strategic pathway to sustainable success.

You might also be interested in:

July 19, 2024

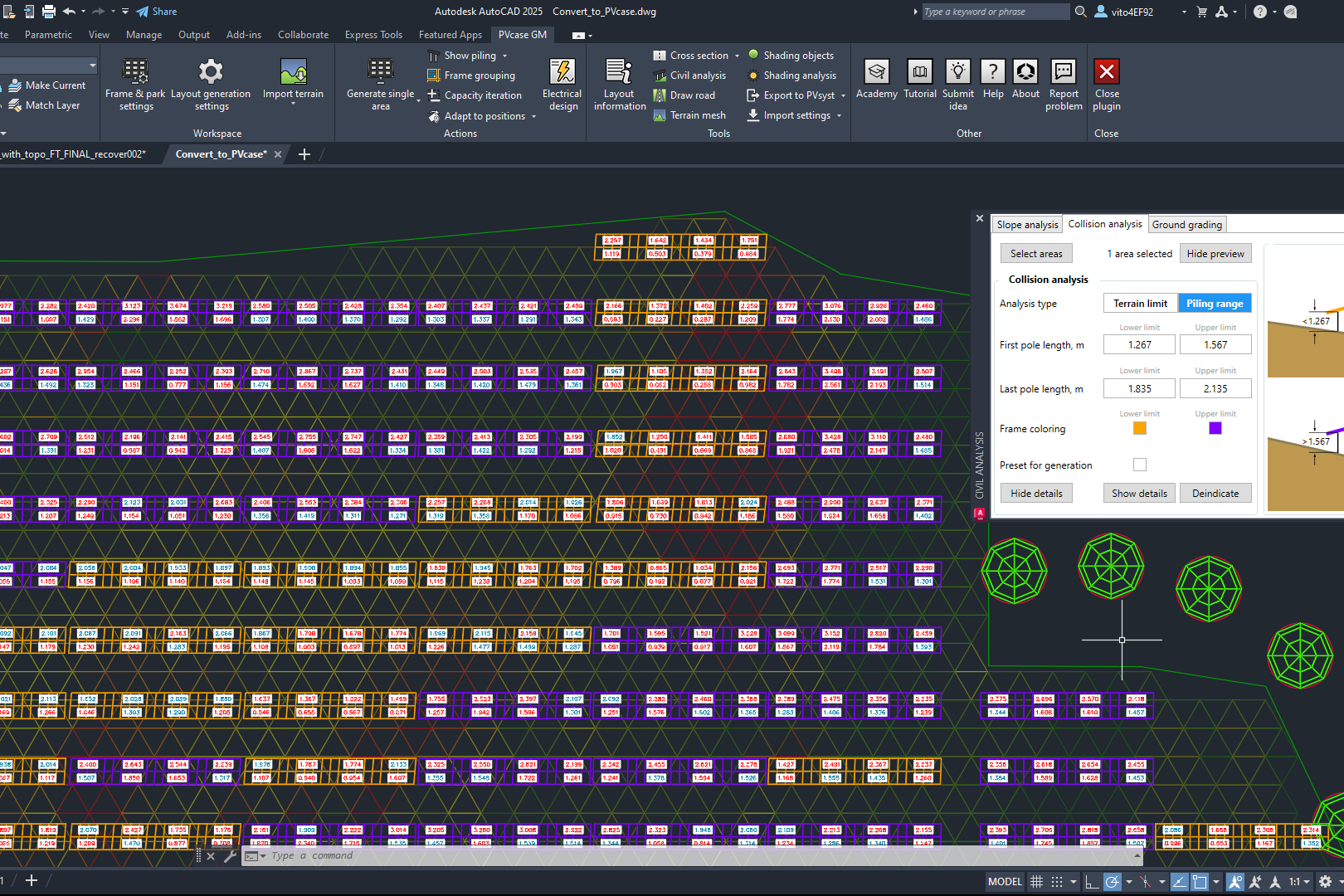

Siting of PV power plants. How to adapt solar designs to complex terrains?

Choosing the wrong PV project site lowers energy output, raises costs, and risks legal issues. PVcase offers solutions. Discover them by reading the article.

July 16, 2024

Overcoming technical challenges in renewable energy projects. How PVcase transformed OHLA’s design process

Explore how OHLA overcame renewable energy design challenges with PVcase, streamlining solar park operations and achieving remarkable business growth.

July 3, 2024

Bridging the renewable energy skills gap. A success story of PVcase, Enery, and the University of Applied Sciences Upper Austria

Discover how PVcase, Enery, and the University of Applied Sciences Upper Austria have collaborated to prepare future solar engineers through an innovative educational initiative,…

July 1, 2024

Top 10 questions from Intersolar Europe 2024, answered

Get answers to the top 10 questions asked during Intersolar Europe 2024 that cover PVcase Prospect's availability, integration of PVcase products, and much more. Your question is…

June 19, 2024

Targeted solar marketing for successful landowner outreach — e-book included!

Discover how innovative strategies and Anderson Optimization's GIS Site Selection can boost solar outreach ROI and conversions. Download the ebook for more insights!

June 3, 2024

PVcase is part of the 42-month long SUPERNOVA project

PVcase, together with 19 partners from all over the world, is part of the 42-month SUPERNOVA project, focusing on O&M and grid-friendly solutions for reliable, bankable, and…

May 29, 2024

PVcase tools are now compatible with AutoCAD 2025!

We’re happy to announce that you can now use PVcase Ground Mound and Roof Mount, our flagship CAD-based tools, on AutoCAD 2025, enjoy its multiple functionalities and integrate…

May 20, 2024

PVcase is the finalist of “The smarter E AWARD” in the Photovoltaics category

We’re the finalists of “The Smarter E AWARD”! Read more about the nomination and dive into the PVcase Integrated Product Suite offering that innovates the industry.

May 14, 2024

Making great designs on good sites—the importance of topo data for PV design

Topo data is the first step in determining the success of your solar project. While the terrain is crucial in this regard, developers should also consider grid connectivity and…

April 29, 2024

How policy can shape future solar energy expansion

Policymakers and regulatory organizations must actively support solar power's growth and renewable energy advancement. Read the article to learn how.

April 25, 2024

Shading Analysis: advanced feature for C&I roof-mount solar projects is live

Shading Analysis is live! Read the article to learn about benefits, capabilities of the tool, and how it can help users and decision-makers.

April 9, 2024

PVcase wins the BNEF Pioneer Award 2024 for innovative solar design solutions

We won the prestigious 2024 BNEF Pioneers Award! Find out how our software contributes to relieving bottlenecks in the deployment of clean power.

March 29, 2024

Sustainable cities: what urban living of the future might look like

From clean energy to green bonds and renewable energy stocks, there are many ways you can invest your money in a sustainable future. Find them out by reading the article.

March 22, 2024

8 ways to invest your money in a sustainable future

From clean energy to green bonds and renewable energy stocks, there are many ways you can invest your money in a sustainable future. Find them out by reading the article.

March 21, 2024

8 business opportunities in renewable energy

There are many potentially lucrative business opportunities in renewable energy. Learn how you can use these opportunities to make money while contributing to the green…