While the Baltics is not traditionally the brightest spot on the global solar industry map, the situation will change soon. The participants of Solarplaza Summit Baltics 2023, which took place in Vilnius, Lithuania, identified significant challenges and possibilities in the region.

General overview of the Baltic renewable energy market

The solar industry in the Baltics (Latvia, Estonia, and Lithuania) is strongly influenced by our unique geopolitical and geographical situation. One of the most critical steps of the Baltic countries is the planned exit of the BRELL agreement in 2025. This agreement covers Belarus, Russia, and the Baltics.

The Baltic states are also currently synchronized with Continental Europe Synchronous Area (CESA), which makes Baltic states more vulnerable to Nordic and Central European electricity price fluctuations. However, the synchronization with the CESA grid will prevent Russia from disrupting critical supplies of electricity in the Baltics and, as such, will promote energy security.

Moreover, Lithuania recently had a government-imposed cap on solar installation projects, which curtailed future development. The overall power of solar parks could not exceed 2GW. However, after much debate the 2GW cap has already been lifted.

The Baltic countries face some further challenges when it comes to the adoption and implementation of solar energy:

- Large competition for available connections to distribution and transmission networks.

- In Estonia, micro-producers cannot sell their electricity to the grid due to grid capacity issues. Grid investments would require €300 million, and the construction process could take around 3-5 years. Transmission construction is more challenging than renewable energy resource build-outs due to regulated industry, land ownership, engineering complexity, supply chain and other issues.

- Limited sunlight. The Baltic region is located at a high altitude, meaning the amount of sunlight received is lower than in countries closer to the equator. This makes solar energy less effective in the region and limits its potential. However, today solar energy is becoming more competitive than wind.

- Land is not always connected to the grid. While the Baltic countries have much good land for build-outs, it is usually used for agricultural and recreational purposes. Moreover, good land plots are not well-connected to the grid.

- Lack of investment. The adoption of solar energy in the Baltic countries is still in its early stages, and there is a lack of investment and financing for solar projects. This can make investing in solar energy difficult for businesses and homeowners. The good thing is that Lithuania has regulations for remote solar power plants.

- Regulatory barriers. The regulatory framework for solar energy in the Baltic countries is still developing, and some barriers must be addressed. For example, connecting solar installations to the grid in some countries can be challenging and discourage investment in solar energy.

However, there is some good news. The Baltic governments have implemented several policies and incentives to promote renewable energy development, including solar. For example, in Estonia, renewable energy producers can receive a premium tariff for the electricity they generate. In Latvia, the government offers a feed-in tariff for solar power producers. Lithuania’s net metering scheme allows households and businesses to sell their excess solar energy back to the grid.

Moreover, Lithuanian energy company Ignitis purchased a 200 MW hybrid solar-wind project in Latvia. The operational solar capacity of Ignitis is expected to increase.

Under the European Regional and Development Fund (ERDF) and the Cohesion Fund, 839 million euros will be invested in renewable energy sources between 2021 and 2027 to increase Latvia’s energy security, efficiency, and resilience to climate change.

Baltic power market outlook and expected revenues

Alexander Esser of Aurora Energy Research presented a pretty optimistic view of the Baltic power market. Here are the key takeaways from the presentation:

- Prices will drop in all three Baltic states until 2030 as gas markets rebalance. Renewable build-out decreases the Lithuanian prices relative to Estonia and Lithuania until 2030. Most of the current demand is covered by local generation and imports from the Nordic countries.

- Due to the upcoming electrification of transport, industry, and heating, the Baltics will need 14TWh more electricity by 2050.

- Solar production is rapidly increasing in the Baltics. Electricity production will also increase.

- Solar capture prices will decline until the 2030s, after which the increased system’s flexibility reduces the discount to baseload prices. Onshore wind will face similar tendencies due to more capacity entering the system. However, solar prices start below onshore but will rise above them in the 2030s. Additional solar build-out in the late 2040s and 2050s counteracts the impact of increased flexibility.

Market opportunities and challenges in the Baltics

The participants of the panel discussion Key Market Opportunities and Challenges in the Baltics, moderated by PVcase R&D specialist Algirdas Ducinskas, identified a few more issues in the Baltics.

Lithuania faces an issue with the grid’s ability to absorb the projected capacity. This is why smaller-scale solar projects are a more viable option here. However, the Lithuanian government has set a goal to generate 9GW of additional power from renewables by 2030, which cannot be met with small-scale solar. With current inflation and supply chain issues influencing growth and 65% of electricity imported, such goals can be achieved only by having a clear regulatory framework.

In Latvia, since the 1st of April 1st, developers have had to pay a deposit to reserve capacity on the grid. This will hopefully provide a clearer view of the additional required capacity of the grid. Latvia currently faces the demand for a further 5GW of electricity. They also plan to convert many projects into solar/wind plants.

Rytis Kevelaitis, CEO of Energy Unlimited, stated that we have to achieve energy independence as soon as possible due to the ongoing energy crisis. Renewables are one of the straightest paths toward it.

Bankability and investment landscape for solar projects in Baltics

Environmental, social, and corporate governance is a major driving force for banks to fund renewable projects. More than half of the investments of the European Investment Bank are related to the climate action space. However, the return on investment of renewable energy was excellent in the past, but now banks are very concerned about how low electricity prices can go.

The terms of Power Purchase Agreements are getting more complicated due to

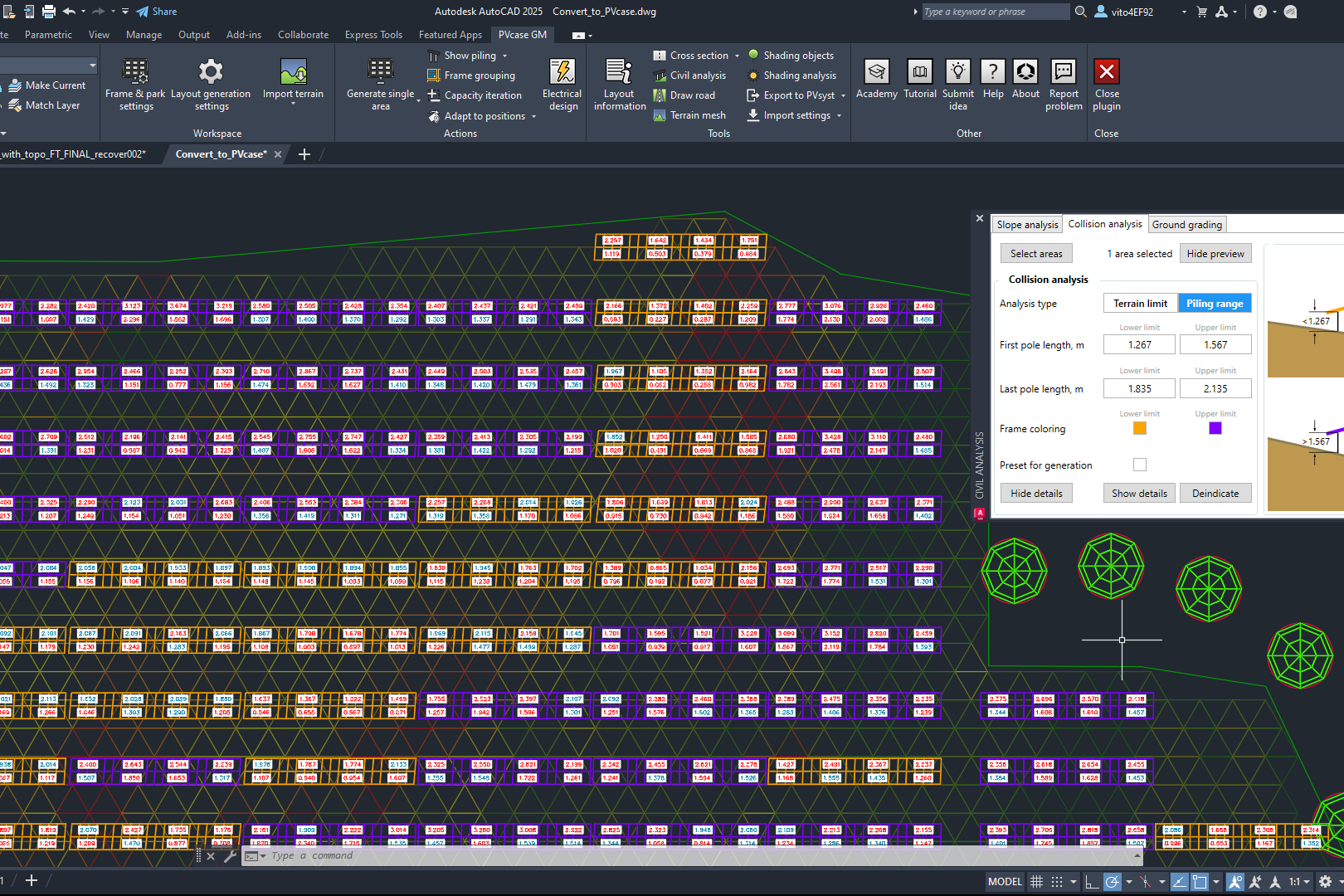

expectations for accurate pricing modeling before the development of the project. Usually, there are expectations for lower PPA pricing, and, as a result, we can expect more merchant projects. The solar industry must improve to guarantee bands a more predictable cash flow. Cashflow predictability will always be the number one priority of banks. Such tools as PVcase Yield gives accurate estimates on generated KWH and KW corresponding to optimized designs. This helps to improve CAPEX and OPEX ratio and improve the LCOE, the main KPI of an energy asset.

Summary

The challenges of the Baltic states are similar to other European markets, just on a different scale. The significant obstructions include grid capacity and flexibility, supply chain issues, slow permission procedures, and lack of consistent legislative framework, incentives, and tax credits. Moreover, Russia’s invasion of Ukraine has created a more urgent need to push the development of renewable projects forward.

If you are interested into the renewable energy sector, PVcase is hiring. Check our open positions here.

You might also be interested in:

July 19, 2024

Siting of PV power plants. How to adapt solar designs to complex terrains?

Choosing the wrong PV project site lowers energy output, raises costs, and risks legal issues. PVcase offers solutions. Discover them by reading the article.

July 16, 2024

Overcoming technical challenges in renewable energy projects. How PVcase transformed OHLA’s design process

Explore how OHLA overcame renewable energy design challenges with PVcase, streamlining solar park operations and achieving remarkable business growth.

July 3, 2024

Bridging the renewable energy skills gap. A success story of PVcase, Enery, and the University of Applied Sciences Upper Austria

Discover how PVcase, Enery, and the University of Applied Sciences Upper Austria have collaborated to prepare future solar engineers through an innovative educational initiative,…

July 1, 2024

Top 10 questions from Intersolar Europe 2024, answered

Get answers to the top 10 questions asked during Intersolar Europe 2024 that cover PVcase Prospect's availability, integration of PVcase products, and much more. Your question is…

June 19, 2024

Targeted solar marketing for successful landowner outreach — e-book included!

Discover how innovative strategies and Anderson Optimization's GIS Site Selection can boost solar outreach ROI and conversions. Download the ebook for more insights!

June 3, 2024

PVcase is part of the 42-month long SUPERNOVA project

PVcase, together with 19 partners from all over the world, is part of the 42-month SUPERNOVA project, focusing on O&M and grid-friendly solutions for reliable, bankable, and…

May 29, 2024

PVcase tools are now compatible with AutoCAD 2025!

We’re happy to announce that you can now use PVcase Ground Mound and Roof Mount, our flagship CAD-based tools, on AutoCAD 2025, enjoy its multiple functionalities and integrate…

May 20, 2024

PVcase is the finalist of “The smarter E AWARD” in the Photovoltaics category

We’re the finalists of “The Smarter E AWARD”! Read more about the nomination and dive into the PVcase Integrated Product Suite offering that innovates the industry.

May 14, 2024

Making great designs on good sites—the importance of topo data for PV design

Topo data is the first step in determining the success of your solar project. While the terrain is crucial in this regard, developers should also consider grid connectivity and…

April 29, 2024

How policy can shape future solar energy expansion

Policymakers and regulatory organizations must actively support solar power's growth and renewable energy advancement. Read the article to learn how.

April 25, 2024

Shading Analysis: advanced feature for C&I roof-mount solar projects is live

Shading Analysis is live! Read the article to learn about benefits, capabilities of the tool, and how it can help users and decision-makers.

April 9, 2024

PVcase wins the BNEF Pioneer Award 2024 for innovative solar design solutions

We won the prestigious 2024 BNEF Pioneers Award! Find out how our software contributes to relieving bottlenecks in the deployment of clean power.

March 29, 2024

Sustainable cities: what urban living of the future might look like

From clean energy to green bonds and renewable energy stocks, there are many ways you can invest your money in a sustainable future. Find them out by reading the article.

March 22, 2024

8 ways to invest your money in a sustainable future

From clean energy to green bonds and renewable energy stocks, there are many ways you can invest your money in a sustainable future. Find them out by reading the article.

March 21, 2024

8 business opportunities in renewable energy

There are many potentially lucrative business opportunities in renewable energy. Learn how you can use these opportunities to make money while contributing to the green…