The levelized cost of energy (LCoE) refers to the average cost of the energy produced throughout the life of various energy-generating assets. In terms of power plants, LCoE is tied to how much it costs to generate a single unit of electricity over the lifetime of the plant. It’s often marked as dollars per megawatt hour ($/MWh).

LCoE is used to evaluate methods of energy production and can be considered as an average electricity price for a specific generation method to break even. The levelized cost of solar PV could potentially predict whether the project would, at a bare minimum, cover its own expenses or if the solar park doesn’t hold up against alternative choices.

The importance of solar LCoE

The investment-gain ratio is a fundamental part of any power plant. The LCoE of utility-scale photovoltaics (PV) is one of the essential assessments to determine if the project is viable and worth getting into. If the solar park can barely break even according to initial LCoE calculations, it might be better to move on to a project that shows more potential.

LCoE is primarily used by policymakers for long-term planning. The formula to calculate the LCoE seeks to assess a variety of factors that can be costly in the long run. Further, you may need to account for different factors, depending on the specific asset you’re making calculations for. For example, looking at the marginal costs to utilize coal, LCoE costs would have to include the price of coal as a material, while solar does not have such expenses.

However, it should be noted that these comparisons are often regarded as a guideline, not hard proof that the project is viable. Higher or lower LCoE is purely a theoretical prediction, but it’s one of the main elements that can influence investors’ interest, as it’s considered proof of the financial viability of solar PV power plants. LCoE calculations can even include tax benefits, such as depreciation of the installation.

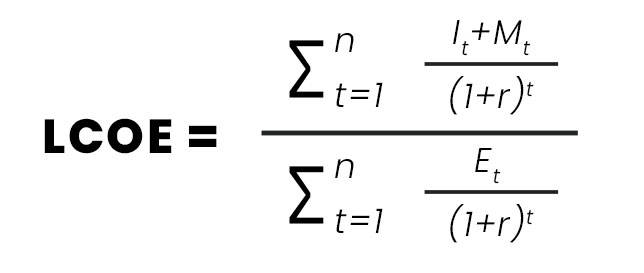

LCoE formula and calculation

The costs calculated by LCoE can fall under three major categories: wholesale costs, retail costs and external (societal) costs. Additionally, calculations involved in the LCoE need to account for both the present values and the future values that will come into effect. Costs include financing, annual expenses and site irradiance characteristics.

Other important aspects of the formula include maintenance costs or even loans associated with various projects. The underperformance of any of these elements affects solar LCoE. For example, if the initial investment is quite large, but the overall yield of the project is low due to a poorly selected location which would require a lot of maintenance and upkeep, such a plant would likely be rejected as it would be deemed loss-making.

Here’s a breakdown of the formula:

It = Investment and expenditures for the year (t)

Mt = Operational and maintenance expenditures for the year (t)

Et = Electricity production for the year (t)

r = Discount rate that could be earned in alternative investments

n = Lifetime of the system

Units of measurement

LCoE is typically expressed in dollars per megawatt hour ($/MWh). A megawatt hour (MWh) represents 1,000 kilowatts of electricity generated per hour. As of 2023 in the United States, the global levelized cost of electricity for utility-scale solar PV ranged between $30 and $180 per megawatt hour.

However, it’s not enough to compare the projected cost against these averages. As mentioned previously, the value of output versus cost is the most important assessment that needs to be made. Ultimately, it doesn’t matter if the cost is more or less than is typical for solar PV; rather, it matters whether it’s cost-effective for the individual project and as compared to other options.

Solar LCoE compared to other renewable energy sources

Other renewable energy sources include options such as wind energy, geothermal energy, hydropower, and bioenergy. Each renewable resource is under constant innovation and development, and their feasibility and efficiency can reasonably be expected to shift and improve over time.

Solar and wind energy continue to consistently perform well in terms of cost per output compared to other options. However, again, the best option for a company will ultimately depend heavily on the scope and resources of each individual venture.

How to assess the value of solar LCoE?

So, what does this all mean in terms of what your company actually needs to do to determine whether solar power is the right option? A great start will be to do as follows:

- Assess the location. Consider the ease of access to both natural and manmade resources in the area, like exposure to sunlight and structural assets. This will ensure, for example, that there’s room for various roof and ground mounts.

- Review industry regulations. Consider the costs of adhering to all pertinent laws, regulations, and standards, both now and in the future.

- Calculate upfront costs. It’s important to know exactly how much a transition to solar energy will cost you upfront and how you intend to fund that upgrade in the short term.

- Estimate energy needs and output. Create a projection for your projects’ base energy needs and compare this against the estimated output of a solar park.

- Conduct uncertainty and risk analyses. These analyses will seek to make room for unforeseen issues in your cost estimations.

- Compare different options for renewable energy. Obtain quotes and run tests to compare the output, cost, and efficiency of different options.

By taking these steps, you can more effectively assess the potential lifetime value of a solar energy upgrade for your specific projects and avoid any mishaps during the process.

You might also be interested in:

July 19, 2024

Siting of PV power plants. How to adapt solar designs to complex terrains?

Choosing the wrong PV project site lowers energy output, raises costs, and risks legal issues. PVcase offers solutions. Discover them by reading the article.

July 16, 2024

Overcoming technical challenges in renewable energy projects. How PVcase transformed OHLA’s design process

Explore how OHLA overcame renewable energy design challenges with PVcase, streamlining solar park operations and achieving remarkable business growth.

July 3, 2024

Bridging the renewable energy skills gap. A success story of PVcase, Enery, and the University of Applied Sciences Upper Austria

Discover how PVcase, Enery, and the University of Applied Sciences Upper Austria have collaborated to prepare future solar engineers through an innovative educational initiative,…

July 1, 2024

Top 10 questions from Intersolar Europe 2024, answered

Get answers to the top 10 questions asked during Intersolar Europe 2024 that cover PVcase Prospect's availability, integration of PVcase products, and much more. Your question is…

June 19, 2024

Targeted solar marketing for successful landowner outreach — e-book included!

Discover how innovative strategies and Anderson Optimization's GIS Site Selection can boost solar outreach ROI and conversions. Download the ebook for more insights!

June 3, 2024

PVcase is part of the 42-month long SUPERNOVA project

PVcase, together with 19 partners from all over the world, is part of the 42-month SUPERNOVA project, focusing on O&M and grid-friendly solutions for reliable, bankable, and…

May 29, 2024

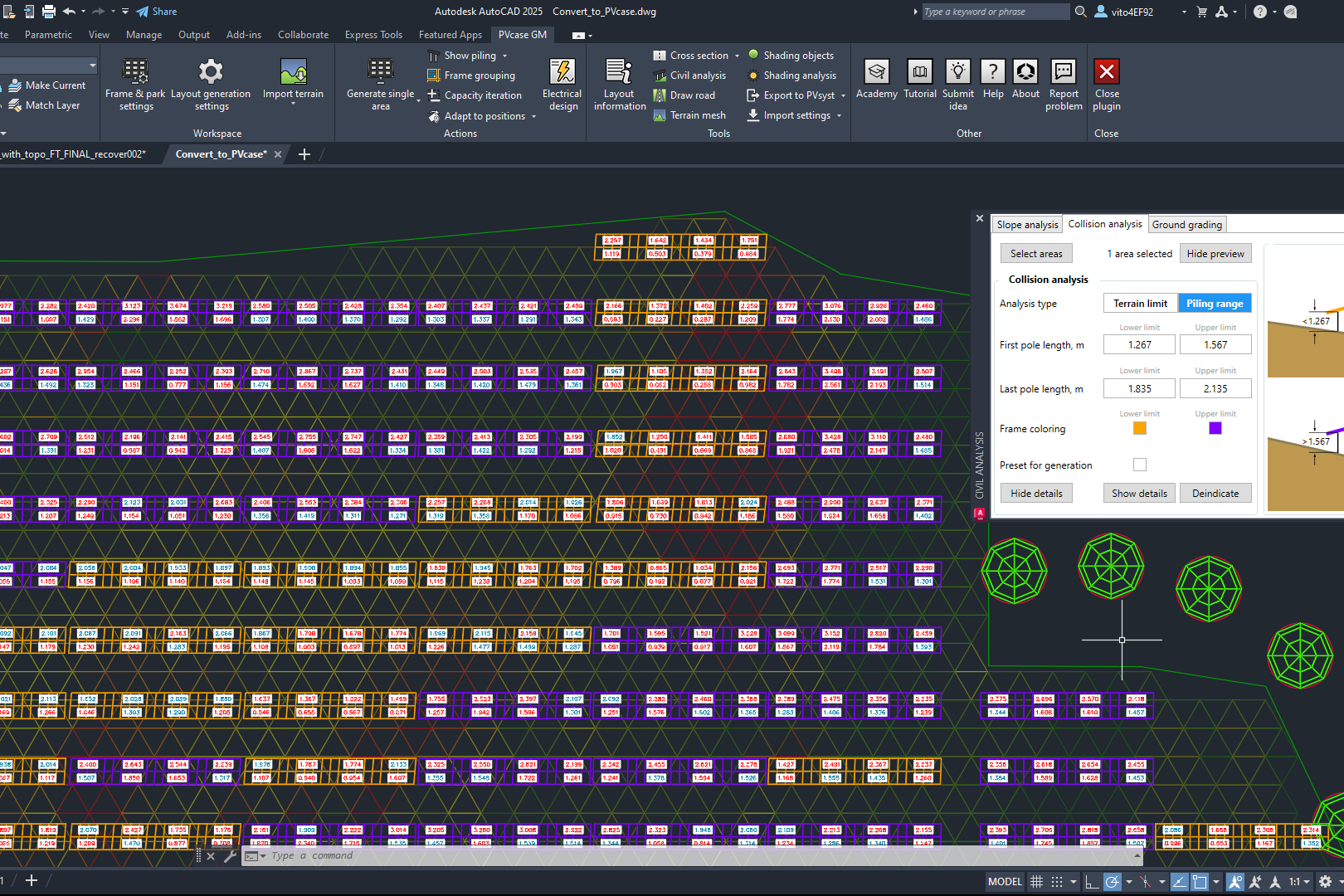

PVcase tools are now compatible with AutoCAD 2025!

We’re happy to announce that you can now use PVcase Ground Mound and Roof Mount, our flagship CAD-based tools, on AutoCAD 2025, enjoy its multiple functionalities and integrate…

May 20, 2024

PVcase is the finalist of “The smarter E AWARD” in the Photovoltaics category

We’re the finalists of “The Smarter E AWARD”! Read more about the nomination and dive into the PVcase Integrated Product Suite offering that innovates the industry.

May 14, 2024

Making great designs on good sites—the importance of topo data for PV design

Topo data is the first step in determining the success of your solar project. While the terrain is crucial in this regard, developers should also consider grid connectivity and…

April 29, 2024

How policy can shape future solar energy expansion

Policymakers and regulatory organizations must actively support solar power's growth and renewable energy advancement. Read the article to learn how.

April 25, 2024

Shading Analysis: advanced feature for C&I roof-mount solar projects is live

Shading Analysis is live! Read the article to learn about benefits, capabilities of the tool, and how it can help users and decision-makers.

April 9, 2024

PVcase wins the BNEF Pioneer Award 2024 for innovative solar design solutions

We won the prestigious 2024 BNEF Pioneers Award! Find out how our software contributes to relieving bottlenecks in the deployment of clean power.

March 29, 2024

Sustainable cities: what urban living of the future might look like

From clean energy to green bonds and renewable energy stocks, there are many ways you can invest your money in a sustainable future. Find them out by reading the article.

March 22, 2024

8 ways to invest your money in a sustainable future

From clean energy to green bonds and renewable energy stocks, there are many ways you can invest your money in a sustainable future. Find them out by reading the article.

March 21, 2024

8 business opportunities in renewable energy

There are many potentially lucrative business opportunities in renewable energy. Learn how you can use these opportunities to make money while contributing to the green…