The solar industry in Poland has been experiencing significant growth in recent years. The country has been actively working to diversify its energy mix and reduce its dependence on coal, leading to an increased focus on renewable energy sources like solar power.

Recently, these topics were explored in an event that brought together leading experts, professionals, and innovators in the solar energy industry – Solarplaza Summit Poland took place in Warsaw on 9 May 2023. Guy Atherton, PVcase Ground Mount product manager, also participated in the event by taking part in the panel discussion “Scaling Large Scale PV Projects With the Right Technology Applications.”

Let’s explore the innovative approaches and technologies discussed at Solarplaza Summit Poland, paving the way for a greener and more sustainable future.

Poland has favorable conditions for solar energy generation, with a good amount of sunlight throughout the year. The government has introduced several measures to promote the development of the solar industry, including feed-in tariffs, net metering, and renewable energy auctions.

Furthermore, renewable energy auctions have driven Poland’s solar industry’s growth. These auctions allow developers to compete for contracts to sell electricity generated from renewable sources, including solar. They have helped attract investment and promote the development of large-scale solar projects.

The Polish government has also set ambitious renewable energy targets. The National Renewable Energy Action Plan aims for renewable sources to account for 21% of Poland’s energy consumption by 2020 and 32% by 2030. Solar power is expected to play a crucial role in achieving these targets.

Poland’s increasing solar market in numbers

According to the European Commissioner for Energy report published at the end of August 2022, over 20 GW of renewable energy was installed in Poland. 11 GW came from solar installations. It’s over 80% more than at the end of August 2021, when total solar capacity amounted to 6 GW.

Solar PV will cover around 10% of the country’s electricity in 2022, while it covered just about 1% three years ago. This rapid increase is primarily due to the popularity of home solar installations in the country and highly favorable financial conditions for their owners. Energy Market Agency reported that by the end of August 2022, Poland had 1,131,973 micro-installations under 50 kW. The country’s metering system allowed residents with systems of up to 10 kW to feed 1 kWh into the grid and receive 0.8 kWh for free. For larger installations above 10 kW, this ratio was 1 to 0.7. Moreover, residents did not have to pay the distribution fees for using the grid.

Such growth in micro installation introduced challenges for the distribution framework and caused nationwide policy changes. As a result, in April of 2022, the net-metering system was replaced by the net-billing system, which uses hourly settlement to calculate the energy injected and retrieved from the grid. This new scheme rewarded consumers for surplus energy fed into the grid at the wholesale price while they paid for the consumed energy just like regular consumers.

Solar energy also has high public support in national polls. A survey commissioned by the Polish Photovoltaic Association in 2022 revealed that more than half of the Poles want solar installations in their neighborhoods, while 2 out of 5 respondents think installing solar panels on all buildings is a good idea.

Key drivers and challenges of the Polish solar market

Below we identify key driving factors and challenges of the Polish solar market identified in the European Commissioner for Energy report.

Key drivers

– Favorable legal framework encouraging growth.

– Geopolitical context. Russia’s aggression against Ukraine caused an increase in energy prices and a lack of raw materials. Such circumstances also catalyzed the need for energy independence from Russian sources and self-sufficiency.

– The change from a net-metering scheme to a more advanced net-billing framework.

– The increased subsidies towards residential solar. From mid-December until the end of March 2023, the subsidies towards residential solar have been increased by 50%, while the rebates on battery installations have been more than doubled.

Key challenges

– Limited grid capacity to new power sources. Most of the grid is around 40 years old and requires modernization.

– Government-imposed electricity price cap. The Polish government has recently adopted an act limiting electricity prices that protect citizens from uncontrolled price raises. As a result, it limits the income of energy producers and companies. The cap in effect until the end of 2023 will likely negatively affect virtual power purchase agreements.

Summary

Despite the challenges mentioned above, Poland remains one of the fastest-growing solar markets in Europe and ranks third in the top 10 solar PV market additions list for 2023-2026. The solar industry in Poland is driven by government incentives, favorable solar conditions, and the country’s commitment to renewable energy. With ongoing efforts to promote solar power, Poland is expected to continue its expansion in the solar industry and contribute to its overall energy transition.

You might also be interested in:

July 19, 2024

Siting of PV power plants. How to adapt solar designs to complex terrains?

Choosing the wrong PV project site lowers energy output, raises costs, and risks legal issues. PVcase offers solutions. Discover them by reading the article.

July 16, 2024

Overcoming technical challenges in renewable energy projects. How PVcase transformed OHLA’s design process

Explore how OHLA overcame renewable energy design challenges with PVcase, streamlining solar park operations and achieving remarkable business growth.

July 3, 2024

Bridging the renewable energy skills gap. A success story of PVcase, Enery, and the University of Applied Sciences Upper Austria

Discover how PVcase, Enery, and the University of Applied Sciences Upper Austria have collaborated to prepare future solar engineers through an innovative educational initiative,…

July 1, 2024

Top 10 questions from Intersolar Europe 2024, answered

Get answers to the top 10 questions asked during Intersolar Europe 2024 that cover PVcase Prospect's availability, integration of PVcase products, and much more. Your question is…

June 19, 2024

Targeted solar marketing for successful landowner outreach — e-book included!

Discover how innovative strategies and Anderson Optimization's GIS Site Selection can boost solar outreach ROI and conversions. Download the ebook for more insights!

June 3, 2024

PVcase is part of the 42-month long SUPERNOVA project

PVcase, together with 19 partners from all over the world, is part of the 42-month SUPERNOVA project, focusing on O&M and grid-friendly solutions for reliable, bankable, and…

May 29, 2024

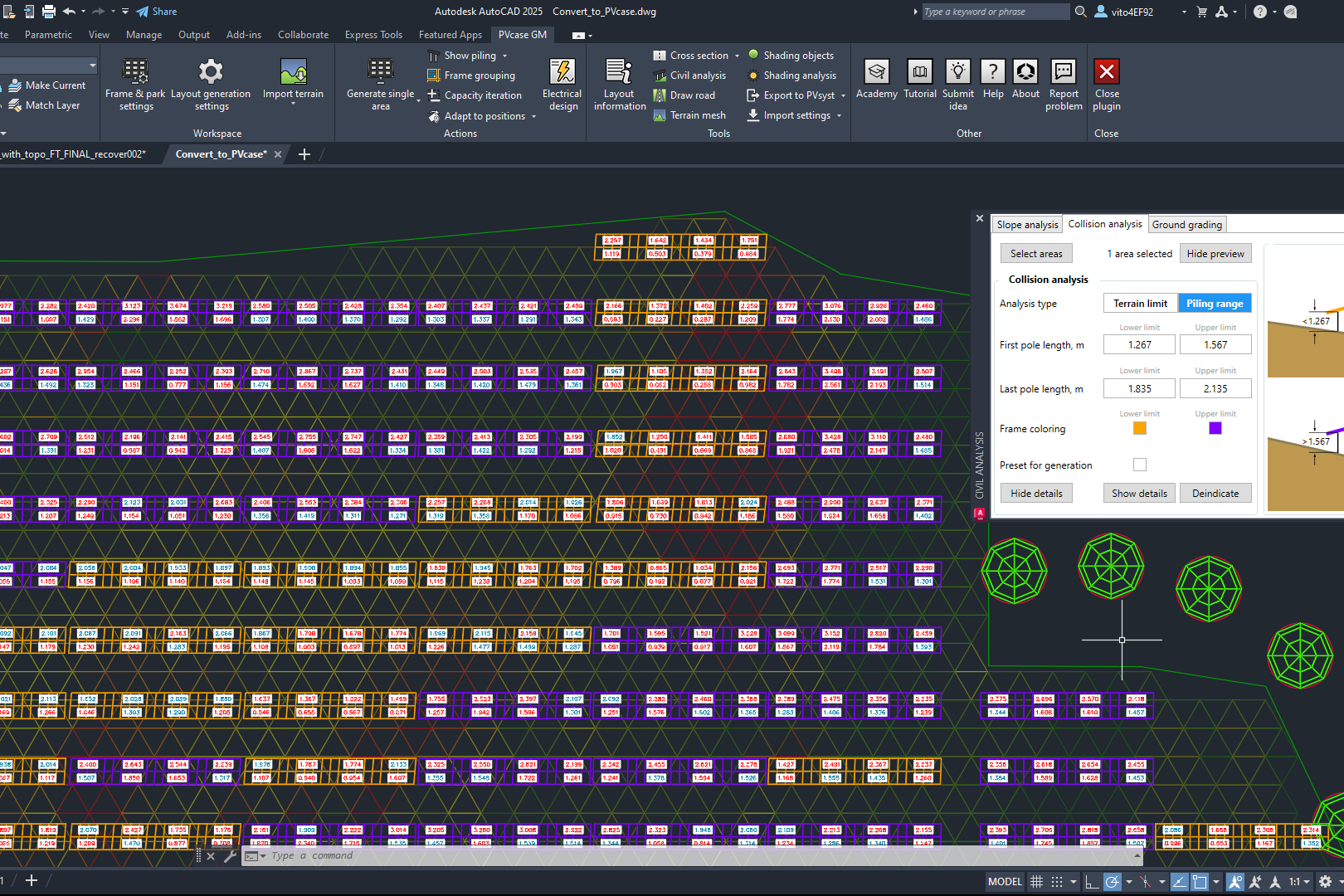

PVcase tools are now compatible with AutoCAD 2025!

We’re happy to announce that you can now use PVcase Ground Mound and Roof Mount, our flagship CAD-based tools, on AutoCAD 2025, enjoy its multiple functionalities and integrate…

May 20, 2024

PVcase is the finalist of “The smarter E AWARD” in the Photovoltaics category

We’re the finalists of “The Smarter E AWARD”! Read more about the nomination and dive into the PVcase Integrated Product Suite offering that innovates the industry.

May 14, 2024

Making great designs on good sites—the importance of topo data for PV design

Topo data is the first step in determining the success of your solar project. While the terrain is crucial in this regard, developers should also consider grid connectivity and…

April 29, 2024

How policy can shape future solar energy expansion

Policymakers and regulatory organizations must actively support solar power's growth and renewable energy advancement. Read the article to learn how.

April 25, 2024

Shading Analysis: advanced feature for C&I roof-mount solar projects is live

Shading Analysis is live! Read the article to learn about benefits, capabilities of the tool, and how it can help users and decision-makers.

April 9, 2024

PVcase wins the BNEF Pioneer Award 2024 for innovative solar design solutions

We won the prestigious 2024 BNEF Pioneers Award! Find out how our software contributes to relieving bottlenecks in the deployment of clean power.

March 29, 2024

Sustainable cities: what urban living of the future might look like

From clean energy to green bonds and renewable energy stocks, there are many ways you can invest your money in a sustainable future. Find them out by reading the article.

March 22, 2024

8 ways to invest your money in a sustainable future

From clean energy to green bonds and renewable energy stocks, there are many ways you can invest your money in a sustainable future. Find them out by reading the article.

March 21, 2024

8 business opportunities in renewable energy

There are many potentially lucrative business opportunities in renewable energy. Learn how you can use these opportunities to make money while contributing to the green…